All Categories

Featured

Table of Contents

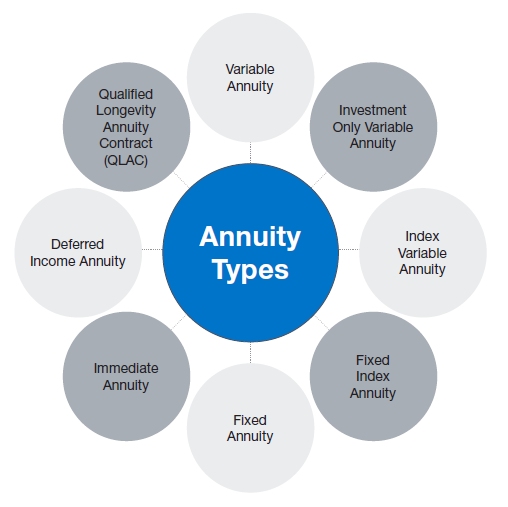

dealt with index annuities: Set index inhabit a middle-ground between set and variable annuities, supplying a mix of risk protection and market-based growth possibility. Unlike a taken care of annuity that gives a surefire rate of interest rate, a fixed indexed annuity is connected to a broad market index. Your returns are based on the performance of this index, subject to a cap and a floor.

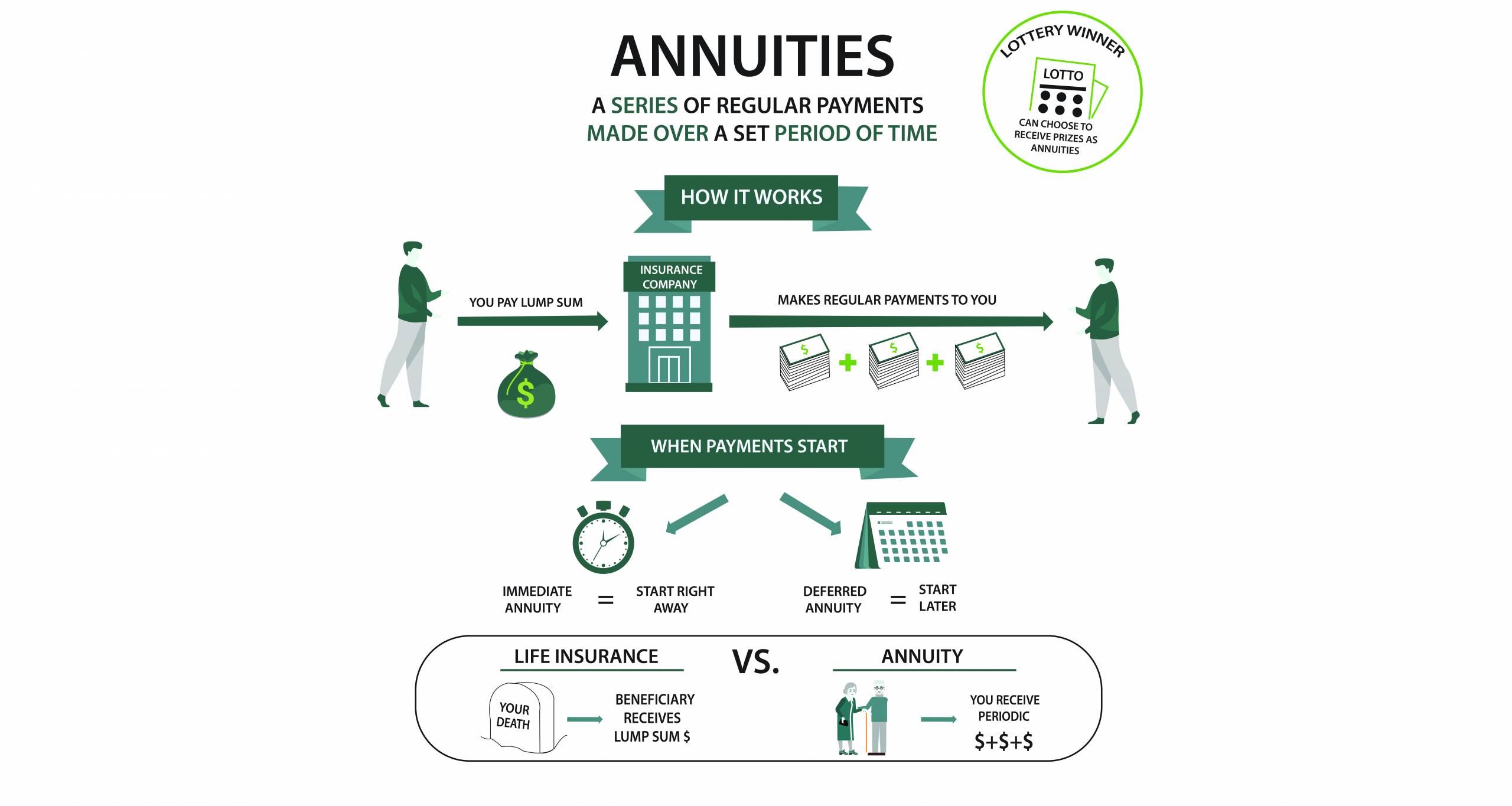

This can offer an attractive equilibrium for those seeking modest growth without the greater risk profile of a variable annuity. Called a prompt earnings annuity, it is often picked by retired people that have currently built up their retirement savings are looking for a trusted means to generate regular revenue like an income or pension plan payment that starts right away.

If you think a repaired annuity could be the right choice for you, below are some points to consider. Annuities can supply routine, foreseeable income for an established variety of years or the rest of your life. Nonetheless, normally speaking, the longer you desire repayments to last, the lower the amount of each repayment.

Survivor benefit: It is very important to consider what will certainly happen to the cash in your fixed annuity if you pass away while there's still an equilibrium in your account. A survivor benefit feature enables you to assign a beneficiary who will receive a defined amount upon your fatality, either as a round figure or in the kind of ongoing settlements.

Certified annuities are funded with pre-tax dollars, usually through retirement plans like a 401(k) or individual retirement account. Costs payments aren't thought about gross income for the year they are paid, but when you take income in the circulation phase, the entire quantity is generally based on tax obligations. Nonqualified annuities are funded with after-tax bucks, so tax obligations have currently been paid on the contributions.

For instance, the Guardian Fixed Target Annuity SM uses an assured price of return for three-to-ten year durations (all may not be offered in all times). You can pick the moment duration that finest fits your retired life period. We can link you with a regional economic expert that can clarify your alternatives for all types of annuities, examine the readily available tax obligation advantages, and aid you decide what makes sense for you.

Exploring Indexed Annuity Vs Fixed Annuity A Comprehensive Guide to Fixed Vs Variable Annuity Pros Cons Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why Fixed Vs Variable Annuity Pros And Cons Is Worth Considering Fixed Annuity Or Variable Annuity: A Complete Overview Key Differences Between Tax Benefits Of Fixed Vs Variable Annuities Understanding the Key Features of Variable Vs Fixed Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing Indexed Annuity Vs Fixed Annuity FAQs About Fixed Income Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Variable Vs Fixed Annuity

Lots of people very carefully calculate the amount of money they'll require to live comfortably in retired life and invest their functioning years saving for that goal, some still fear not having sufficient. This worry casts an also bigger darkness on respondents currently in or near retirement.

After the accumulation duration, the issuer gives a stream of repayments for the remainder of your life or your selected duration. Annuities can be a vibrant automobile to include in your retirement income mix, particularly if you're concerned regarding running out of cash.

Breaking Down Annuity Fixed Vs Variable A Closer Look at Variable Vs Fixed Annuity Defining Variable Annuity Vs Fixed Annuity Pros and Cons of Fixed Annuity Or Variable Annuity Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Risks of Fixed Vs Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Immediate Fixed Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Indexed Annuity Vs Fixed Annuity A Closer Look at Variable Annuities Vs Fixed Annuities

A set annuity is one of the most uncomplicated kind, offering a dependable and foreseeable income stream. The insurer ensures a fixed interest rate on your premium, which produces a stable earnings stream over the rest of your life or a details period. Like certifications of down payment, these annuities are often the go-to solution for more risk-averse capitalists and are among the most safe financial investment alternatives for retirement portfolios.

Typical dealt with annuities may lack security from inflation. Set annuities have a stated rate of interest price you make no matter of the market's performance, which may mean missing out on out on prospective gains.

While you can take part in the market's benefit without risking your principal, taken care of index annuities restrict your return. While you can buy other annuities with a stream of repayments or a lump amount, instant annuities require a swelling amount.

As with many annuities, you can make a decision whether to receive payments for a particular duration or the remainder of your life. Immediate annuities give a consistent stream of income you can't outlast.

Here are seven questions to ask to assist you locate the right annuity. Think about when you want to begin receiving annuity payments. Immediate annuities have a brief or no build-up duration, while credit annuities can last over one decade. You have a number of options throughout and kind of settlements, consisting of fixed duration, life time, joint lifetime settlements, and round figure.

Exploring the Basics of Retirement Options Key Insights on Your Financial Future Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuities Pros and Cons of Various Financial Options Why What Is A Variable Annuity Vs A Fixed Annuity Is Worth Considering How to Compare Different Investment Plans: How It Works Key Differences Between Variable Vs Fixed Annuities Understanding the Key Features of What Is A Variable Annuity Vs A Fixed Annuity Who Should Consider Fixed Income Annuity Vs Variable Growth Annuity? Tips for Choosing Indexed Annuity Vs Fixed Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Index Annuity Vs Variable Annuity A Closer Look at Tax Benefits Of Fixed Vs Variable Annuities

Different annuities have various charges. Comprehend the costs connected with your selected annuity. Check with economic score companies like Standard & Poors, AM Finest, Moody's, and Fitch.

Annuities can be complex and complex, also for experienced investors. That's why Bankers Life offers individualized support and education and learning throughout the process. We specialize in understanding your demands and guiding you towards remedies to help you accomplish your suitable retired life.

Each individual ought to seek details guidance from their own tax obligation or lawful consultants. To determine which financial investment(s) might be proper for you, please consult your monetary specialist previous to investing.

Both Individual retirement accounts and deferred annuities are tax-advantaged means to prepare for retired life. However they function in very various means. As pointed out over, an individual retirement account is an interest-bearing account that offers tax advantages. It is like a basket in which you can place different sorts of investments. Annuities, on the various other hand, are insurance items that transform some financial savings right into assured payments.

Review on for more clarification and contrasts. A private retirement account (IRA) is a sort of retirement cost savings vehicle that allows financial investments you make to expand in a tax-advantaged way. They are a fantastic way to save long-term for retirement. An individual retirement account isn't a financial investment in and of itself.

Breaking Down Fixed Index Annuity Vs Variable Annuities A Closer Look at How Retirement Planning Works Breaking Down the Basics of Fixed Indexed Annuity Vs Market-variable Annuity Pros and Cons of Fixed Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Annuity Vs Variable Annuity Who Should Consider Indexed Annuity Vs Fixed Annuity? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Fixed Annuity Or Variable Annuity Financial Planning Simplified: Understanding Fixed Index Annuity Vs Variable Annuity A Beginner’s Guide to Fixed Annuity Or Variable Annuity A Closer Look at How to Build a Retirement Plan

Usually, these financial investments are supplies, bonds, mutual funds, or even annuities. Each year, you can invest a specific quantity within your IRA account ($6,500 in 2023 and subject to change in the future), and that financial investment will expand tax complimentary.

When you withdraw funds in retired life, though, it's tired as normal income. With a Roth individual retirement account, the cash you place in has currently been taxed, yet it expands free of tax throughout the years. Those earnings can then be taken out free of tax if you are 59 or older and it has been at least five years given that you initially added to the Roth individual retirement account.

Analyzing Tax Benefits Of Fixed Vs Variable Annuities A Comprehensive Guide to Investment Choices Defining Deferred Annuity Vs Variable Annuity Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: A Complete Overview Key Differences Between Fixed Income Annuity Vs Variable Annuity Understanding the Key Features of Variable Vs Fixed Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Immediate Fixed Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

No. IRAs are retirement cost savings accounts. Annuities are insurance products. They operate in entirely various methods. You can occasionally place annuities in an IRA though, or make use of tax-qualified individual retirement account funds to acquire an annuity. There might be some crossover, but it's the kind of crossover that makes the essential distinctions clear.

Annuities have been around for a very long time, but they have actually come to be a lot more common recently as people are living much longer, fewer individuals are covered by typical pension, and preparing for retirement has actually become much more crucial. They can frequently be integrated with various other insurance products like life insurance to create full security for you and your family.

Table of Contents

Latest Posts

Vanguard Annuity Reviews

Variable Annuity Required Minimum Distribution

Rates

More

Latest Posts

Vanguard Annuity Reviews

Variable Annuity Required Minimum Distribution

Rates